Analysis of Monday's Trades

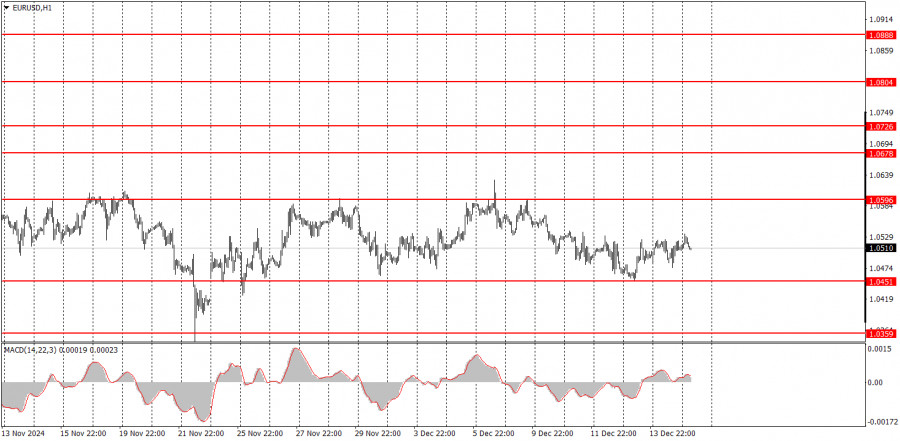

1H Chart of EUR/USD

On Monday, the EUR/USD currency pair continued to trade within the horizontal channel of 1.0451–1.0596. We have specifically zoomed out the chart to show how long the price has remained within this sideways range. Thus far, there are no signs of the flat movement ending. This week, there are plenty of macroeconomic and fundamental events in the U.S. and the Eurozone. However, we must remind you that over the past three weeks, numerous significant news releases have also occurred, yet the pair remains in a flat phase. Therefore, the presence of important events does not guarantee the end of the flat trend.

Yesterday's business activity indices from Germany, the Eurozone, and the U.S. were highly contradictory. While the services sector showed solid results, the manufacturing sector disappointed across all mentioned regions. Consequently, the euro responded appropriately to the macroeconomic background by failing to define a clear direction on Monday.

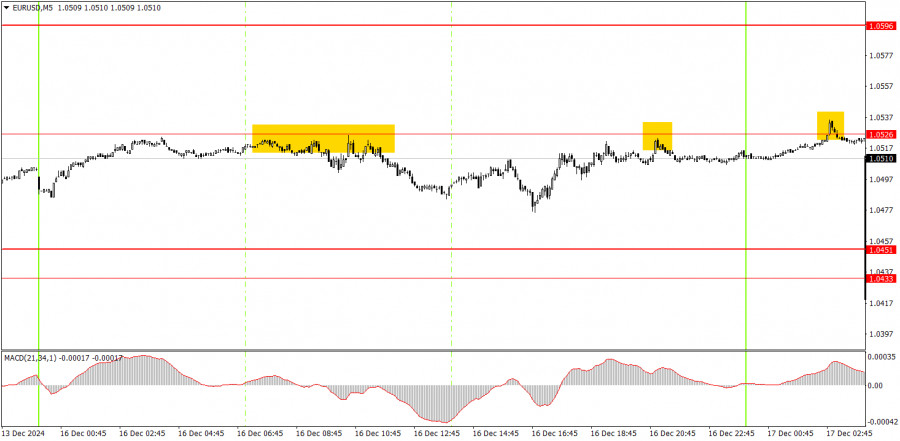

5M Chart of EUR/USD

On Monday, the 5-minute timeframe showed two trading signals for selling. The price bounced twice from the 1.0526 level and a third time during the night. At least the first signal was worth executing, but the nearest target level was not achieved. Therefore, novice traders could have closed positions manually to secure a profit. Today, a few reports will be released in both the Eurozone and the U.S., which theoretically may allow the euro to continue rising.

Trading Strategy for Tuesday:

The EUR/USD pair remains in corrective mode while trading within the sideways range of 1.0451–1.0596 on the hourly timeframe. After a two-month decline, there is no rush to buy the euro. This week, the price could break through the channel's lower boundary, signaling the resumption of the downward trend that began three months ago. However, much will depend on macroeconomic data and fundamental factors.

It is challenging to expect a clear movement from the pair on Tuesday. Although there will be a fair number of economic releases today, traders failed to break the channel's lower boundary. Therefore, a continuation of the euro's growth is possible.

On the 5-minute timeframe, the following levels are relevant for trading: 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896. On Tuesday, the Eurozone will publish several German reports on business climate, economic expectations, and sentiment, which we consider secondary. In the U.S., data on industrial production and retail sales will be released. These are more significant reports, but it is unlikely that they will lead to strong market movements today.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.