The GBP/USD currency pair also showed impressive growth on Monday, for which there were no local reasons. Out of the blue, growth began in the European trading session and even before the start of the US session, the pound sterling rose by 120 pips. In part, this movement was unfair, since last Thursday the pound sterling also fell by more than 120 pips, without any local reasons for this. However, we would like to remind you that we are still in a downward trend. And in a downward trend, new rounds of decline should not cause any surprise.

The broader questions are why the pound rose on Monday and why it didn't decline on Friday. On Friday, the U.S. ISM Services PMI came in higher than expected; however, the pound began to increase on Monday even before the release of secondary reports. Despite these reports being published, it's still unclear why the market was buying the pound. The only relevant data point, the second estimate of the UK Services PMI for December, showed a lower-than-expected reading. As a result, over the past three days, we have witnessed contradictory and illogical movements in the market.

Based on this conclusion, we can draw several other conclusions. Firstly, the market could have started a global correction, which will last at least several weeks. Secondly, we can't count on logical movements of the pair in the near future. This week, there will be many important reports in the US, the market's reaction to them will confirm or dispel our fears. If, on the basis of strong data from overseas, we again see the growth of the British pound or a purely nominal growth of the dollar, which will immediately be covered by the growth of the pound, it will reinforce our expectations of a corrective phase.

While even a multi-week correction may occur, it will not alter our medium-term outlook for the GBP/USD exchange rate. We maintain the view that the British currency lacks the foundation for medium-term growth. Any correction could serve as an opportunity to "unload" indicators and oscillators that have repeatedly entered oversold territory over the past two months, showing bullish divergences.

In our assessment, the pound sterling could recover to the 1.2800 level; however, this rise would not signify the start of a new upward trend. More specifically, regarding the hourly timeframe, this could be interpreted as a new upward trend lasting two to three weeks. Nevertheless, the downward trend would remain intact in the daily timeframe and even more so in the weekly chart. We believe the pound will continue declining in 2025, with a minimal target set at $1.1800. And this is just a minimal target for the British currency, which now faces the prospect of a Bank of England poised to cut rates more than twice this year.

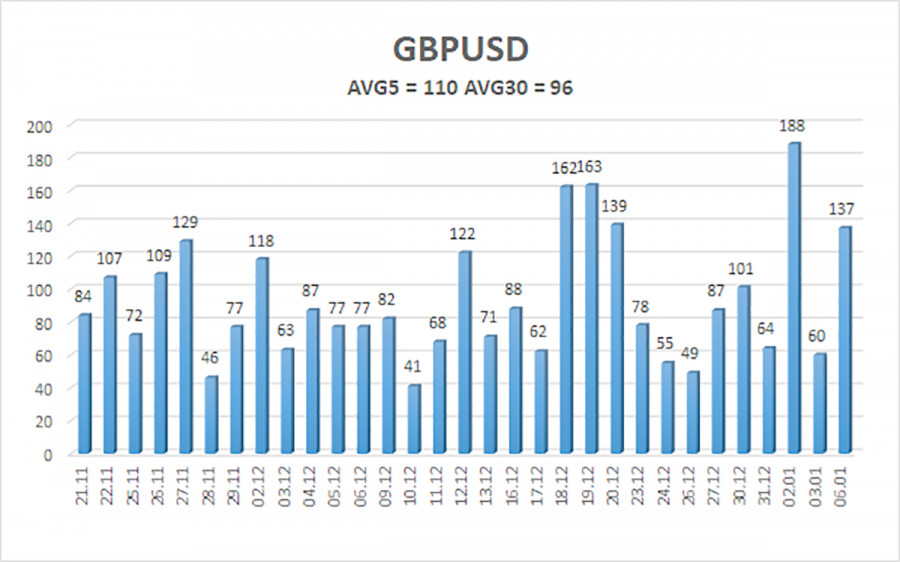

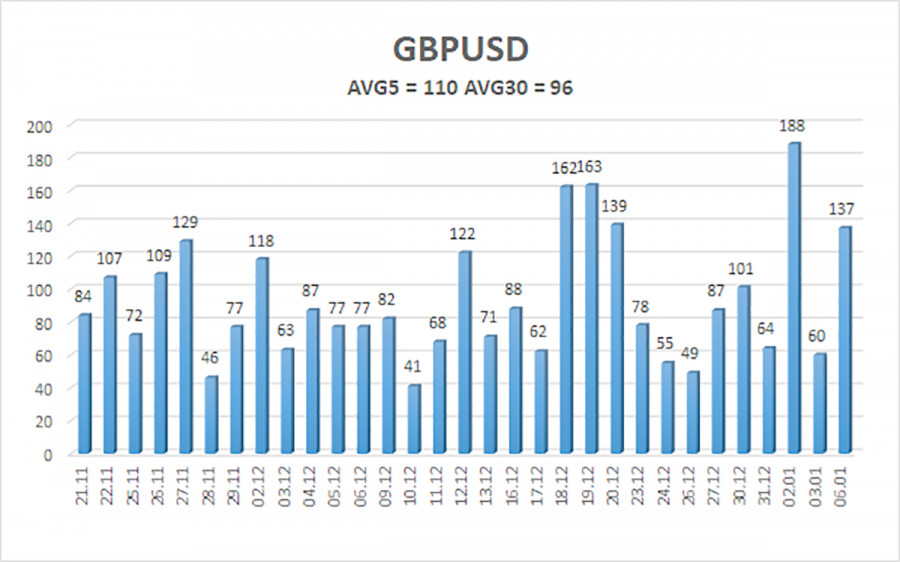

The average volatility of the GBP/USD pair over the last five trading days is 110 pips, considered "average" for the pair. Therefore, on Tuesday, January 7, we expect the pair to move between 1.2399 and 1.2619. The higher linear regression channel is pointing downward, signaling a bearish trend. The CCI indicator has again entered the oversold zone, but any oversold condition in a downtrend is merely a signal for a correction. The bullish divergence on this indicator also indicated a correction, which has already been completed.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2329

- S3 – 1.2207

Nearest Resistance Levels:

- R1 – 1.2573

- R2 – 1.2695

- R3 – 1.2817

Trading Recommendations:

The GBP/USD pair maintains its downward trend. We continue to avoid long positions as we believe all growth factors for the British currency have already been priced in multiple times, with no new factors supporting further gains. If you trade based on "pure" technical analysis, longs are possible with targets at 1.2573 and 1.2619 if the price settles above the moving average line. Sell orders remain much more relevant, with targets at 1.2399 and 1.2329, but it is necessary to wait for the price to settle back below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.