Bitcoin and Ethereum have experienced a slight recovery after another sell-off, reaching new yearly lows. The panic seen in both the U.S. stock market and the cryptocurrency market has paused, but it's far from over. Today's achievements are not yet significant. We may only be able to discuss hitting the bottom after another major decline in risky assets and a wave of liquidations in the cryptocurrency market. Additionally, this liquidation should be accompanied by rapid and substantial buying from long-term investors.

After updating the low to nearly $76,500, Bitcoin currently trades at $83,600. Ethereum also dropped during Asian trading to around $1,750, but the move was bought back, leading to a recovery to around $1,869.

Meanwhile, a bill has been introduced in Texas to purchase BTC and other cryptocurrencies worth $250 million. While the crypto industry experiences ups and downs, Texas seems intent on strengthening its position as a crypto hub. The state legislature has introduced a bill proposing a significant investment of $250 million in the purchase of Bitcoin and other cryptocurrencies. This initiative, which has sparked broad discussion, is justified by the need for asset diversification and the potential of digital currencies.

Supporters of the bill argue that it will allow Texas to benefit from the growing popularity of cryptocurrencies and attract even more innovative companies to the state. However, the project has also faced criticism. Opponents are concerned about the volatility of the crypto market and the associated risks to public funds. They call for more careful analysis before making such a significant investment. Despite the disagreements, the bill demonstrates governments and financial institutions' growing interest in cryptocurrencies.

This suggests that, despite short-term negative trends, the current correction could allow long-term investors to acquire cryptocurrencies at more attractive prices. However, for this to happen, we need to see signs of stabilization in the macroeconomic situation and restore trust in the crypto market.

As for the intraday trading strategy, I will focus on significant dips in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

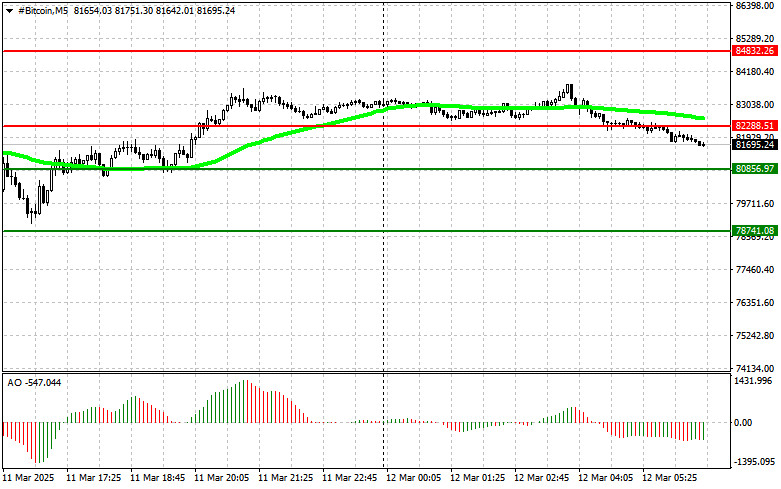

Scenario #1: I plan to buy Bitcoin today when the price reaches around $82,300, with a target rise to $84,800. At $84,800, I will exit the buys and sell immediately on the bounce. Before buying the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Bitcoin can be bought from the lower boundary at $80,800, provided there is no market reaction to the breakout in the opposite direction to levels $82,300 and $84,800.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today when the price reaches around $80,800, with a target decline to $78,700. At $78,700, I will exit the sale and buy immediately on the bounce. Before selling the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Bitcoin can be sold from the upper boundary at $82,300, provided there is no market reaction to the breakout in the opposite direction to levels $80,800 and $78,700.

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today when the price reaches around $1,869, with a target rise to $1,937. At $1,937, I will exit the buys and sell immediately on the bounce. Before buying the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Ethereum can be bought from the lower boundary at $1,836, provided there is no market reaction to the breakout in the opposite direction to levels $1,869 and $1,937.

Sell Scenario

Scenario #1: I plan to sell Ethereum today when the price reaches around $1,836, with a target decline to $1,781. At $1,781, I will exit the sales and buy immediately on the bounce. Before selling the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Ethereum can be sold from the upper boundary at $1,869, provided there is no market reaction to the breakout in the opposite direction to levels $1,836 and $1,781.