Trade Review and Tips for Trading the Euro

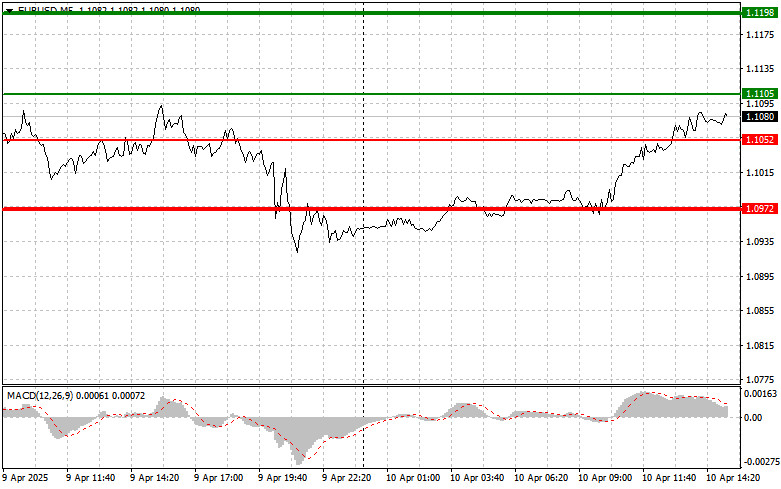

The price test at 1.0974 occurred when the MACD indicator had just begun moving down from the zero line, confirming a valid entry point for selling the euro — however, a proper downward move in the pair never materialized.

As a result, demand for the euro returned by mid-European session. This followed discussions about the EU potentially lifting tariffs imposed on the U.S. If this decision is implemented, it may ease tensions in transatlantic trade relations, which would in turn positively affect the European economy. Investors view such developments as constructive, promoting stability and potentially accelerating economic growth in the eurozone. Naturally, such news drives demand for the euro, boosting its value against other currencies, including the U.S. dollar.

Today, particular attention will be on the U.S. Core Consumer Price Index, which economists believe offers a more accurate gauge of inflationary pressure in the economy. Investors will also closely watch the weekly jobless claims report, which is an important indicator of labor market health. Any unexpected changes in the number of initial claims could significantly influence market sentiment and expectations regarding the Federal Reserve's future policy decisions.

Given the current macroeconomic backdrop, the release of these data points will be a key event likely to shape the short-term direction of financial markets. Strong inflation would restore demand for the dollar, as it would support the Fed's decision to keep interest rates unchanged — even amid the 90-day tariff freeze announced yesterday.

Regarding the intraday strategy, I will mostly rely on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Buy the euro today if the price reaches the area around 1.1105 (green line on the chart), aiming for growth to the 1.1198 level. At 1.1198, I plan to exit long trades and consider reversing into short positions for a pullback of 30–35 points from the entry point. Counting on euro growth today is only reasonable if the U.S. data come in weak. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1052 level, when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a bullish market reversal. Growth can then be expected toward the opposite levels at 1.1105 and 1.1198.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1052 level (red line on the chart), targeting the 1.0972 level, where I plan to exit short trades and open longs in the opposite direction (expecting a 20–25 point move back). Downward pressure on the pair is likely to return if U.S. inflation data surprises to the upside. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1105 level while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a bearish reversal. A decline toward the opposite levels of 1.1052 and 1.0972 can be expected.

Chart Elements Explained:

- Thin green line – entry price for buying the instrument

- Thick green line – suggested price to place Take Profit or manually secure profits, as further growth above this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – suggested price to place Take Profit or manually secure profits, as further decline below this level is unlikely

- MACD indicator – when entering the market, pay attention to overbought and oversold zones

Important Note: Beginner Forex traders must exercise extreme caution when deciding to enter the market. It is best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without them, you can lose your entire deposit very quickly — especially if you neglect money management and trade large volumes.

And remember: successful trading requires a clear plan — like the one I've outlined above. Spontaneous decisions based on current market movements are a losing strategy for any intraday trader.